How to Use a Coupon

The team at E-file.com works very hard to provide users with low prices on its software throughout the tax season. Despite our already low price, we also occasionally provide users with additional discounts. These discounts, whether they are supplied on our website or through a partnering website such as Groupon or RetailMeNot.com, will come in the form of a coupon or promo code.

For example, right now, if you visit our home page you will see the coupon "24OFF" which provides all new users with 20% off the fee for their federal filing software. Please note, discounts only apply to federal software, not state and not third party fees such as e-collect or other bank fees associated with paying for software with your tax refund.

Now, having a coupon code is great, but since it is only truly valuable if you know how and where to use it, we have created the following page to help show users how to use a coupon to receive a discount on their E-file.com software purchase.

Follow these three easy steps to apply a discount to your purchase.

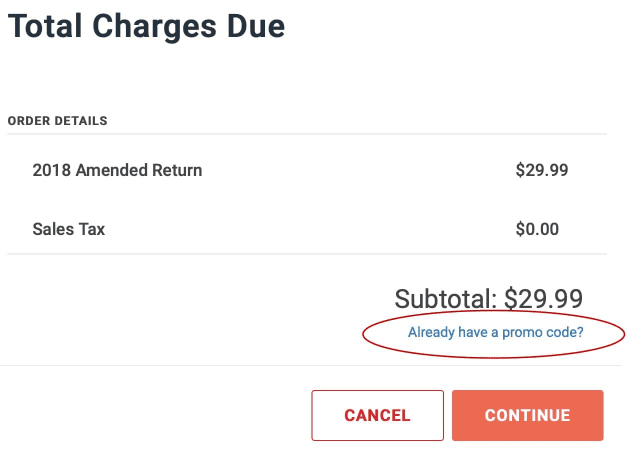

Step 1: Once you reach the checkout page, you will see the total cost for the Products & Services including any state and/or federal filings.

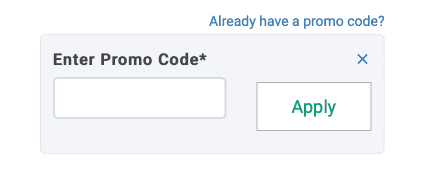

Step 2: Click the little hat/arrow next to the price in the Products & Services section and you will find a link which says "Have a Promo Code?" Click this link and in the field enter your coupon code. Make sure not to add any additional spaces or characters or it will not be accepted. Once this is entered click the "Apply" button.

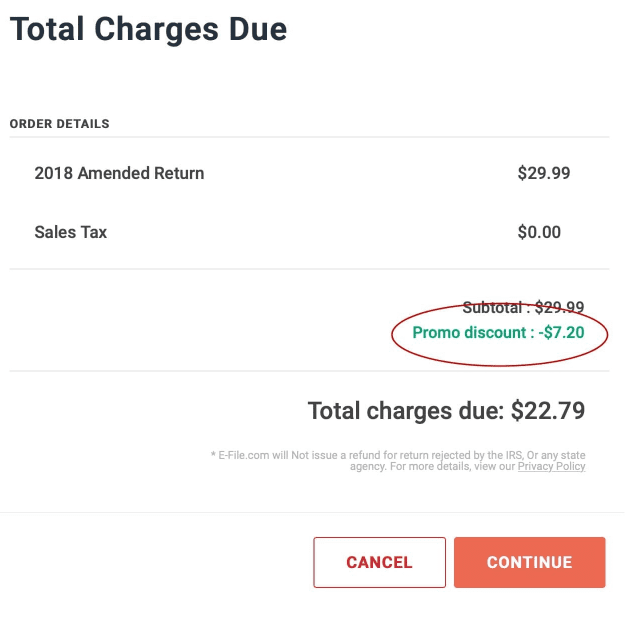

Step 3: Make sure the correct discount is now applied to your purchase.

If you have any trouble with these directions you can contact us outlining the issue you are having here.