$10 Off Your State Taxes + Free Federal Return*

File your taxes in just minutes

Get your refund fast.†

*E-file.com offers free federal tax returns for those who qualify for our Basic Software

E-file State Taxes: What to Know Before You File

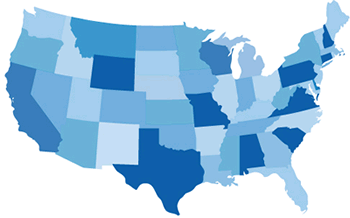

We often hear about the complexity of federal tax law, but no matter how complicated, the law is the same regardless of where you live in the country. The same cannot be said when filing state taxes. Each state sets its own rules for taxation, including rates, what types of taxes are imposed and how they are computed. Even individuals who owe little or no federal taxes can end up with a hefty state bill.

Seven states currently do not impose an income tax. These include Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. Tennessee and New Hampshire tax only interest and dividend income.

If not from income tax, where do proceeds for those states come from? Both Texas and New Hampshire, try to make up for the lost revenue by imposing some of the highest property tax rates in the country. While Tennessee allows local government authorities, even school districts, to impose their own sales tax rates. In some municipalities, rates can reach as much as 9.75 percent.

Of the 41 states that do collect on earned income, seven impose a flat rate, meaning all residents pay the same percentage of their income in taxes, regardless of their income level. These states include Colorado (4.63%), Illinois (3.0%), Indiana (3.4%), Massachusetts (5.3%), Michigan (4.35%), Pennsylvania (3.07%) and Utah (5.0%).

The remaining 34 states use a progressive system similar to the system used by the federal government. This means residents who make above a certain amount pay a higher rate than those making more moderate incomes. Hawaii imposes the highest rate in the country, with residents who make more than $200,000 a year, paying 11 percent in state income taxes.

When considering all the ways a state taxes an individual, California residents can end up paying more than most other states. Their state sales tax is 8.25 percent, the gasoline surcharge is 46.6 cents per gallon, and there is an 87 cent per pack surcharge assessed on cigarettes. The income tax ranges from 1.25 percent to 9.55 percent, with the highest rate assessed on taxable income of just $46,349. An additional one percent surcharge is added for residents making $1 million or more each year. Still, California ranks only fourth in overall tax burden. Californians pay approximately 11.2 percent of income each year.

New York residents bear the highest overall burden in the nation, with residents paying nearly 13 percent of their annual income in state and local taxes. This includes income, sales, gasoline and property. Other states where the overall exceeds 11 percent of income include New Jersey (12.4%), Connecticut (12.3%) and Wisconsin (11.1%).

Enjoying the lowest overall burden of any state are residents of Alaska. Not only do they not pay on income, they also do not face a state-imposed sales tax. Some municipalities do, however. Overall, Alaskans pay out only 6.4 percent of their income every year. Residents of Nevada pay slightly more, approximately 6.6 percent each year. Rounding out the top five lowest taxation states in the country are Wyoming (7.0%), Florida (7.4%) and New Hampshire (7.6%).

Knowing what you will face and how heavy the burden will be can be helpful information. Quality of life can be greatly affected by how much of your income must be dedicated to paying these bills each year. When you’re ready to e-file your state taxes, check out E-file.com