E-file An Extension & Get a FREE 1040 Tax Return*

Extend filing deadline to October 15th

Free 2024 federal & state tax return*

*E-file.com offers free tax return preparation with all extension purchases.

E-file Your IRS Tax Extension

Failure to file your income tax return when it is due can be a costly mistake. It includes a fine of up to 5% of your liability per month. However, there is a convenient provision for obtaining an IRS tax extension for filing your taxes.

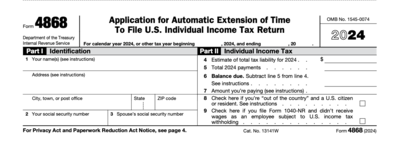

Most individuals and families are required to file by the federal due date each year. For the 2024 tax year, the filing deadline is Tuesday, April 15, 2025. An automatic IRS extension for up to six months can be obtained by completing a Form 4868 with the Internal Revenue Service, but the extension must be filed by or before the federal due date. Once filled, a 1040 return can be completed anytime after the tax filing deadline and before October 15th.

On the Form 4868, you will be asked to estimate your total tax liability. You will also be asked for the sum of all payments that have been made during the tax year, through federal withholding and estimated payments. From this, you will need to determine the approximate amount due, if any.

It's important to understand that adding an extension of time to file does not add an extension of time to pay your tax due. Not paying your tax due by the original deadline (April) may result in a "failure to pay" penalty of half one percent of the unpaid taxes for each month or part of a month the tax is unpaid.

The IRS will charge interest on any unpaid tax from the original due date until the date it's paid in full. The interest rate is determined quarterly and is the federal short-term rate plus 3%.

As with any submission to the IRS, you will need to include your name, address, and Social Security number. If you are making a payment, you will also need to fill in the amount you are paying at this time. There is a box to check if you are currently out of the country and if you will be filing either Form 1040NR or 1040NR-EZ, which are for non-residents living in the United States.

File Your E-file.com Tax Extension

Our website does offer the ability to e-file your tax extension electronically for a fee of $29.99. In 2025, all extensions purchased on E-file.com include our 1040 tax return software, completely free of charge. This allows users who file an extension with us to come back after the filing deadline and before October 15th to file their tax return for free. We can even provide tax filers with an acceptance confirmation number from the IRS. Plus, when you are ready to file your tax return, we already have the information from your extension, which should make filing your return as seamless as possible.

You do have to pay any taxes that are owed to the IRS by the federal due date, or you will owe interest on any unpaid tax. An extension does not provide more time to pay your tax bill; just file your return. You will be charged 0.5% of the unpaid amount per month or partial month that passes until you pay the due amount. If you cannot pay the full amount owed by the deadline, it's still beneficial to pay as much as possible to reduce penalties and interest. The IRS may waive these penalties if you pay more than 90% of what is owed by the regular due date and the rest by the extension due date.

Special Circumstances

There are a few exceptions for filing IRS tax extensions. Someone who is living outside the country and whose main place of business is also outside the country has an automatic two-month extension for filing. If more time is needed, you can request four months in addition to the two months automatically provided.

Military personnel serving in a combat zone or certain other hazardous situations have special extensions that correspond to their time abroad. These tax extensions are automatically provided.

Residents of states affected by federally declared disasters may also receive automatic extensions. The IRS typically announces these special relief provisions when disasters occur.

Filing for an extension is always preferable to filing late or inaccurately. Just remember to pay any taxes that are owed by the federal due date, to avoid any interest or penalties.

State Tax Extensions

It's important to note that a federal extension doesn't automatically extend your state tax filing deadline in all states. Some states grant automatic extensions if you received a federal extension, while others require you to file a separate state form. Be sure to check your state's tax agency website for specific requirements and deadlines.

Filing for an extension is always preferable to filing late or inaccurately. Just remember to pay any taxes that are owed by the federal due date to avoid any interest or penalties.

Frequently Asked Questions

What is a tax extension?

An extension gives you six additional months to file your tax return, moving the deadline from April 15 to October 15. However, it does not extend the time to pay taxes owed.

Do I need to specify a reason?

No, the IRS grants automatic extensions without requiring you to explain why you need the additional time.

What happens if I can't pay what I owe when filing?

You should still file the extension and pay as much as you can to minimize penalties and interest. The IRS offers payment plans if you cannot pay your tax bill in full.