What to Know About Medical Expense Deductions

Various tax deductions could let you recoup some of your medical and dental costs. Although this mainly benefits taxpayers who itemize deductions on Schedule A, certain people can separately subtract these deductible medical expenses from their taxable income. The Affordable Care Act (ACA) brought about several major changes, so it's important to stay up to date on the current rules.

The ACA requires that the majority of Americans have health insurance. Failing to get coverage can cost you in tax penalties. This penalty is occasionally referred to as the "individual mandate" or the "individual shared responsibility payment." This tax penalty will apply for any month that you, your spouse or your dependents do not have health care coverage. However, the penalty may be waived if you do not have coverage for one or two consecutive months, and you qualify for an exemption.

Itemized Medical Deductions

Your ability to deduct medical bills depends on how much of your adjusted gross income they consume. You can calculate your AGI on Form 1040. If health and dental payments surpass 10 percent of this amount, you may claim the excess costs as a medical deduction. The total expense includes money spent on your spouse and qualifying dependents. However, married people who file tax returns separately can only deduct their personal costs.

When you add up your expenses, include any premiums you pay for health insurance. These deductible medical expenses apply to individual, group, Medicare and long-term care plans. Keep in mind that you may only deduct amounts paid out of your taxable income. Don't add any payments that your employer withheld from pretax earnings.

When you lack health insurance or an insurer doesn't reimburse you, it's possible to deduct most out-of-pocket costs. They include fees for a wide range of screenings and treatments. The IRS only allows taxpayers to claim cosmetic surgery expenses if a disease or accident makes an operation necessary. It's legal to subtract vasectomy and sterilization costs. You may also deduct payments for preventive services, such as yearly checkups and eye examinations.

If you visit a hospital or other medical center, you can claim some of the travel expenses. You could subtract payments for fuel, tolls, mass transit tickets or ambulance rides. It's also acceptable to deduct up to $50 per person for lodging each night. This deduction only applies to the patient and one companion.

The government lets people claim tax deductions for dentist appointments. You may subtract the cost of most preventive and corrective services, such as cleanings, fillings and extractions. However, you can't deduct any money you spend on tooth whitening treatments or products. The IRS considers this an optional cosmetic expense.

You may deduct some medication costs on Schedule A. The acceptable deductions include insulin and nearly all prescription drugs. It's also possible to list cost of vitamins or supplements, but you can only do this if a doctor recommends that you use them to treat a diagnosed health problem. The IRS won't let you claim deductions for non-prescription medicines, such as ibuprofen.

Many medical device purchases can reduce your tax bill. Almost any type of equipment is acceptable if it's medically necessary. Approved items include wheelchairs, crutches, eyeglasses, hearing aids and breast pumps. The same goes for artificial limbs or teeth. Most test kits qualify as well. For instance, women may subtract the cost of kits that detect pregnancy.

You may claim a medical deduction after you modify your house for health reasons. However, you can't include any part of the expense that raises your home's resale value. Taxpayers often use this deduction when they suffer debilitating injuries. Acceptable improvements range from wheelchair ramps to metal railings on walls. The IRS will only permit deductions that it considers reasonable and necessary.

Non-Itemized Deductions

If you prefer to claim the standard deduction and skip Schedule A, you might still have an opportunity to subtract certain costs. Anyone with a health savings account (HSA) can deduct personal HSA contributions from taxable earnings. However, you may not include the premiums for an insurance plan that's linked to an HSA. For more on HSA plans and the tax benefits see this page.

Self-employed people usually need to pay for insurance in full, so the IRS lets them take advantage of more health-related income adjustments. If you make a profit, you may subtract long-term care, dental and health insurance premiums. The deduction for HSA deposits applies to self-employed taxpayers as well. You can also include the cost to insure a spouse, dependent or any child up to 26 years old.

State Policies

Many state governments provide additional income tax deductions for people with health care expenses. For example, New Mexico lets taxpayers subtract the cost of medical services for themselves, spouses or dependents as medical expense deductions. Wisconsin allows residents to deduct insurance premiums and personal contributions to health savings accounts. Nevertheless, a number of states offer no medical deductions.

A few important tips apply to any health-related tax adjustment. Remember to keep detailed records; documents and receipts will come in handy if the IRS schedules an audit. Be sure to deduct any credit card payments in the tax year when you charged them. If you ever forget to claim a major deduction, consider filing an amended return. You can complete it up to three years after you make a mistake.

Get the Most out of Deductions for Medical and Dental Expenses

As mentioned earlier, many medical expenses are tax deductible. Especially those not covered by insurance. However, there's an annual threshold that must be exceeded to qualify. It works like this: Taxpayers can deduct qualified medical and dental expenses for everyone listed on their tax returns in excess of 10 percent of adjusted gross income (AGI).

When calculating deductions, first eliminate insurance payments and reimbursements. If the remaining amount surpasses 10 percent of AGI, these expenses can be deductible. For instance, if a taxpayer has an AGI of $45,000, medical expenses exceeding $4,500 can be deducted. Assuming expenses are not offset by insurance reimbursements and the taxpayer had expenses of $6,000, they would be eligible for a deduction of $1,500 ($6,000 - $4,500).

Learning what qualifies as a deductible medical or dental expense can really pay off.

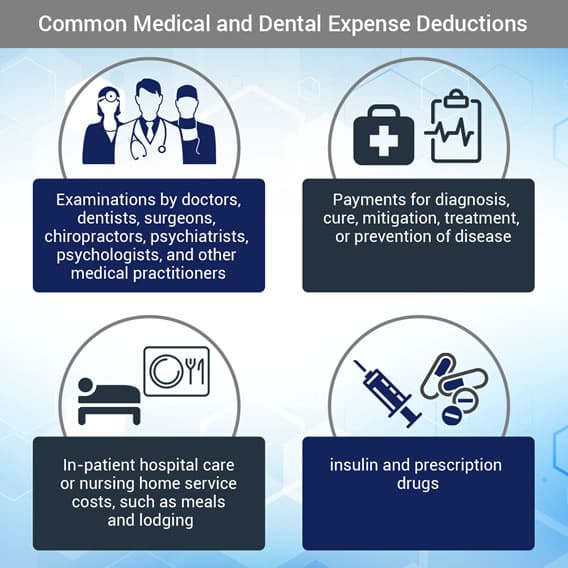

Common Medical and Dental Expense Deductions

Nearly anything prescribed by a physician can qualify as a deduction. While not a comprehensive list, possible deductions include:

- Examinations by doctors, dentists, surgeons, chiropractors, psychiatrists, psychologists, and other medical practitioners

- Payments for diagnosis, cure, mitigation, treatment, or prevention of disease

- In-patient hospital care or nursing home service costs, such as meals and lodging

- Insulin and prescription drugs

Overlooked Potential Medical and Dental Deductions

There is an array of expenses related to medical/dental care that taxpayers may qualify for. A few potential overlooked deductions may include:

- Travel expenses to and from medical treatments. The IRS's current travel deduction is 17 cents per mile

- Uninsured medical treatments, such as eyeglasses, contact lenses, false teeth, hearing aids, and artificial limbs

- Alcohol- or drug-abuse treatments

- Weight-loss programs and diet regimes if a doctor recommends them

- Smoking-cessation treatments, including drugs to alleviate nicotine withdrawal if they require a prescription

- Domestic accommodations that require remodeling for in-home medical care

For a complete list of potential medical and dental deductions, refer to IRS Publication 502 (here).