How to Go About Filing an Amended Tax Return

With all the complexities of the US tax code; there are times when mistakes are made on a tax return. So what do you do when you need to amend your income tax return?

First, you want to make sure that you actually proceed with an amendment. In most cases, you have to file your amended return within three years of the date you filed the original tax return, or two years from the date you paid any tax liability, whichever is the later of the dates.

Now, if the problem with the return is because you did not report income, or you filed under the wrong status or made other errors that would require you to pay more taxes, then you must file an amended return to correct the problems.

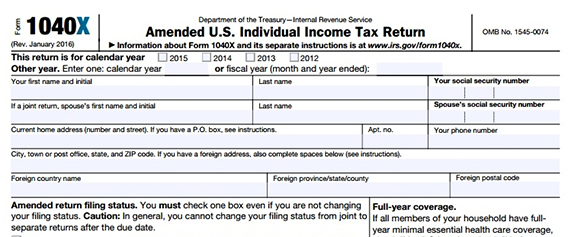

The first step in filing the amended return is to obtain Form 1040X. The 1040X serves a replacement to the original tax return. It also shows the difference between your original taxes and the amended return, so you will have to be prepared to document every deduction in the same manner as when you originally filed.

Make sure to double-check everything; your amended tax return is likely to be examined even more closely than the original return. Occasionally, when filing the amended return you may want to attach a statement for the reason in changing the original return.

1040X forms must be mailed to the IRS and cannot be transmitted online. The address where you will need to mail your forms can be found here. If you need to make a payment with the amended return, you will need to include the payment with your 1040X.

The status of your amended return can sometimes take longer to determine. They also require longer processing time than the typical 1040 tax form. You can track your amended return on the IRS website here. The online tool will tell you if the return has been received, adjusted, or completed. It may take three weeks for your mailed-in return to appear in the online system.