What Your Taxes Actually Pay For

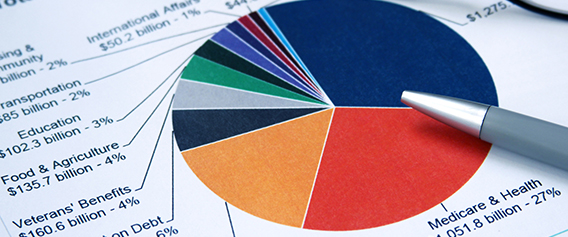

Probably every taxpayer, at some point or another, has found themselves wondering: What do my taxes actually pay for? According to the Center for Policy and Budget Priorities, in fiscal year 2016, the federal government spent $3.9 trillion, $3.3 trillion of which was financed by American taxpayers. Here is a quick breakdown of how this was spent:

Social Security

Social Security payments made up 24 percent of our federal tax spending – that’s why there are periodic calls to reform Social Security to ensure its solvency in the long term.

Healthcare – Medicaid, Medicare, the Children’s Health Insurance Program, and ACA marketplace subsidies

Healthcare payments made up another 26 – 27 percent portion of the federal budget. In 2016, the CPBP reports, Social Security and healthcare together made up slightly more than 50% of the U.S. budget.

Defense and security

Defense spending reflects the costs of running the Department of Defense, operating our military both at home and overseas (including years-long engagements in places like Afghanistan), and other security-related activities for a 16 percent portion of the 2016 budget.

Safety net programs

A smaller portion of the budget (9 percent) went toward supporting various safety net programs for low-income families, the unemployed, the disabled, and others in need of government assistance.

This includes programs like SNAP, or the food assistance program formerly known as food stamps; WIC, which is an assistance program for women and infant children; school meal assistance; low-income housing assistance; childcare programs like Head Start; and others.

All remaining programs

There’s also a portion of the budget that funds various ongoing programs, like medical and scientific research, public education, the arts, transportation, federal retirees and veterans’ benefits, and international aid, for instance. These categories are generally included together as they do not individually make up a significant portion of the budget..

Interest on the U.S.’s debt

And last but not least, the U.S. owes quite a bit of money to its creditors each year in the form of interest payments. In 2016, the CPBP reports, those interest payments reached $240 billion, which equaled about 6% of the budget.

To make sure you’re giving the U.S. only the tax dollars you truly owe, read our post “Tax Refund vs. Correct Withholding – Which Makes Sense for You?”