Tax Documents Checklist

- States Where the IRS Has Extended the Tax Deadline

- Health Savings Plan Distributions & 1099-SA

- Did you receive a state or local refund last year?

- Do I need to report my Social Security benefits?

- Who can take the Retirement Savings Contributions Credit? (Savers Credit)

- How to Report Gambling Winnings with a Form W-2G

- How Do I Claim Refundable Credits After Disallowance?

- What is an IRS Issued Identity Theft PIN (IP PIN)?

- Who Can Take the Credit for the Elderly or Disabled (Schedule R)?

- Did you collect unemployment compensation from a state or local government assistance program?

- What is the Recovery Rebate Credit?

- How to file for a federal or state income tax extension

- Taxpayer COVID-19 FAQ

- The New Simplified 1040 Tax Form

- Are my alimony payments considered earned or taxable income?

- Using an AGI, Self-Select or IP PIN to verify a taxpayer’s ID

- Do I pay taxes on my unemployment benefits from when I was out of work?

- At what point should my dependent file his/her own tax return?

- What is the marriage penalty?

- If a taxpayer works overseas, do they pay federal taxes on the income? What forms need to be completed?

- Bitcoin and tax liability

- Are all state filing laws the same as federal laws? How do I find out the laws in my state?

- What are capital assets, gains and losses? How do I figure them out?

- Is it still possible to get a tax deduction for charitable giving after the latest tax reform?

- Are my tips considered earned or taxable income? What if I forget to report some of them?

Should you continue to itemize or go with the standard deduction now?

For the 2018 tax year, following the Tax Cuts and Jobs Act of 2018 the IRS will reduce the types of allowable deductible expenses for itemized tax returns.

... Read More

Want Your Tax Refund Fast?

Maybe you don’t look forward to doing your taxes. However, if you are one of the millions of Americans who expects a tax refund, you are most likely looking forward to receiving it.

... Read More

How the 2018 Tax Reform Bill Simplified the Filing Process

“For some taxpayers, it will be a little simpler, for some it will be more complex, but overall it will be familiar and folks won’t think of it as some drastic change,” said Joseph Rosenberg, a senior researcher at the nonpartisan Tax Policy Center.

... Read More

Living Abroad? All U.S. Citizens, (Regardless of Where They Reside), May Need to File and Pay U.S. Income Taxes

Most Americans, residing inside the United States, understand that filing an annual tax return and paying taxes is a necessity each year. But for Americans residing outside of the United States there are sometimes questions about who needs to file and pay.

... Read More

Estimated Quarterly Taxes: A Simple Overview

When you are an employee of someone, it’s your employer’s responsibility to ensure that federal and state taxes are being withheld from your paychecks.

... Read More

Child and Dependent Care Tax Credit Boosts Family Income

Childcare expenses can add up quickly, and for many working people can comprise a significant percentage of their income.

... Read More

What the New Tax Laws Mean for Divorcing Couples

Divorce is not a pleasant subject to contemplate, and the impact of divorce on your taxes can add further complexity to situations that are already daunting enough.

... Read More

Who, Why, and How Much? The Earned Income Tax Credit

The Earned Income Tax Credit (EITC) is not one of the tax code’s best-understood provisions, but it is one that can be of benefit to a large portion of the American populace.

... Read More

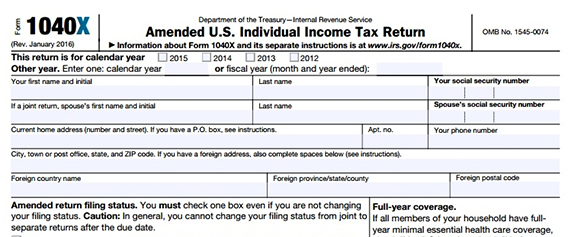

How to Go About Filing an Amended Tax Return

With all the complexities of the US tax code; there are times when mistakes are made on a tax return. So what do you do when you need to amend your income tax return?

... Read More

Tax-related Records: How Long Should You Keep Them?

Tax filing requires having certain records on hand to refer to when documenting your income and other tax-related variables. But after you’ve filed your taxes, it’s not uncommon to wonder just how long you need to keep these documents.

... Read More