File Territory of American Samoa Taxes

Although technically an American possession, American Samoa has its own taxation department. Residents who are native to the Island are not required to file U.S. taxes in many cases. However, Americans who are not native to the territory, but rather live and work there are still required to file Samoa taxes and pay federal taxes to the IRS, as well as file and pay taxes to the American Samoa Island. The taxation rate in this territory averages around 27 percent on all sources of income, including wages, salaries, and self-employment.

Because it is self-governing, it has its own taxation department and its own array of return forms that must be used by taxpayers. People who are uncertain about what forms to utilize when filing Samoa taxes can contact the taxation department in writing at:

American Samoa Government Tax Office

Executive Office Building

First Floor

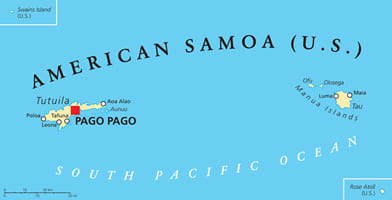

Pago Pago, AS 96799

They can also go online to the government website at www.americansamoa.gov/tax-office-page. If they have specific concerns about whether or not they must pay U.S. taxes, as well as taxes to the territory, people are advised to visit the IRS' website and refer to Publication 570. This publication answers some of the most common questions that non-residents have about filing territory and federal taxes.

Legal Residency

Further, people who are bona fide residents, but also legal residents of the U.S. can have certain sources of income held exempt from taxation. For example, a U.S. citizen who is also a resident of the territory and earns income from worldwide sources can file IRS Form 4563 to request that the worldwide sources of income be exempt from filing Samoa taxes.

Likewise, bona fide residents of the territory who earn incomes derived from sources on the island can use the same form to request that these incomes be held exempt from taxation. People who are self-employed are held to slightly different taxation standards, however. Residents who are self-employed are still required to file IRS Form 1040-SS to pay self-employment taxes that will be used for social programs like Medicare and Social Security.

Investment and Self Employment Taxes Similarly, non-residents and bona fide residents alike who derive income from investments are required to file and submit Form 8960 to pay the appropriate taxes on those monies. Payments for taxes derived from investments and self-employment can be mailed to:

Internal Revenue Service

P.O. Box 1300

Charlotte, NC 28201-1300

USA

Federal government employees must file both federal tax returns, as well as territorial returns. However, on their territorial returns, U.S. federal employees can request that their U.S.-based income be held exempt from taxation. U.S. military members are only required to file federal income tax returns. They do not have to file territorial returns.

Note: States & U.S. territories may make changes to their tax laws with little notice. We do our best to keep this information up-to-date, but it is provided on an "AS IS" basis. For more see our terms.